Get out of debt faster while paying less.

Learn how you can save big by using a balance transfer card.

Read more

Take advantage of introductory 0% APRs

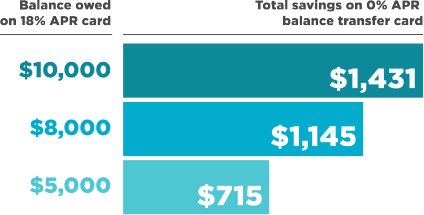

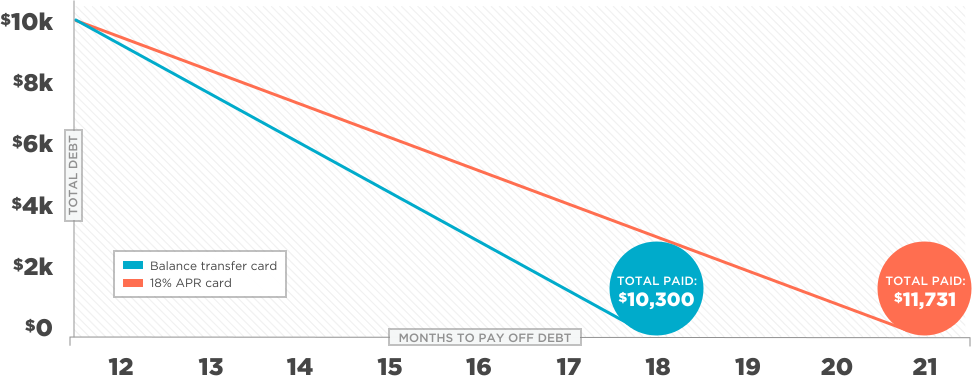

When you’re paying down debt, interest rates matter – a lot. For example, compare the differences between paying down a $10,000 debt on an 18% APR card and a 0% balance transfer card. Using the balance transfer card could save you around $1,431, even after paying a transfer fee of $300. Want to save even more? Sign up for a card that doesn’t charge a transfer fee. As a heads up, the amount you may qualify to transfer and save depends on a variety of factors including your credit worthiness.

Use the right tools for the job

Credit card debt stings. The good news, however, is there’s a way to pay it down with less money in a shorter time. How? By moving your debt to abalance transfer card, which is a credit card that offers a lengthy 0% interest period. Unlike an everyday credit card (which charges interest on balances you carry from month to month), balance transfer cards give you time to pay down debt while preventing interest charges from stacking up.

A balance transfer card can save over $1,000

Total savings:

Financial savings:

$1,431

Pay off debt faster by:

3 months

Know the fees

Make sure you factor in the balance transfer fee (typically 3% to 5%) when choosing a card.

Avoid paying interest

To get the most savings, aim to pay off your debt before interest kicks in.

Use a different provider

You can’t transfer balances between cards from the same issuer. So be sure to apply to a different issuer.

A few of our favorite cards

Best for rewards:

Capital One® Quicksilver® Card – 0% Intro APR for 15 Months

Capital One® Quicksilver® Card – 0% Intro APR for 15 Months is a balance transfer card and rewards credit card in one, especially if you travel. There is No annual fee or foreign transaction fee and it comes with a generous 0% APR offer: 0% on Purchases and Balance Transfers for 15 months. After the intro period, you can expect a 14.74% – 24.74% Variable APR. The card has a welcome offer for new card holders: One-time $150 cash bonus after you spend $500 on purchases within 3 months from account opening. Also, you will earn Earn unlimited 1.5% cash back on every purchase, every day. It is a great choice if you’re trying to earn rewards on new purchases while paying off an old debt. There is a $3 balance transfer fee for the first 60 days.